2026 & Whatnot: Britain Builds the Blueprint for Live Shopping’s Future

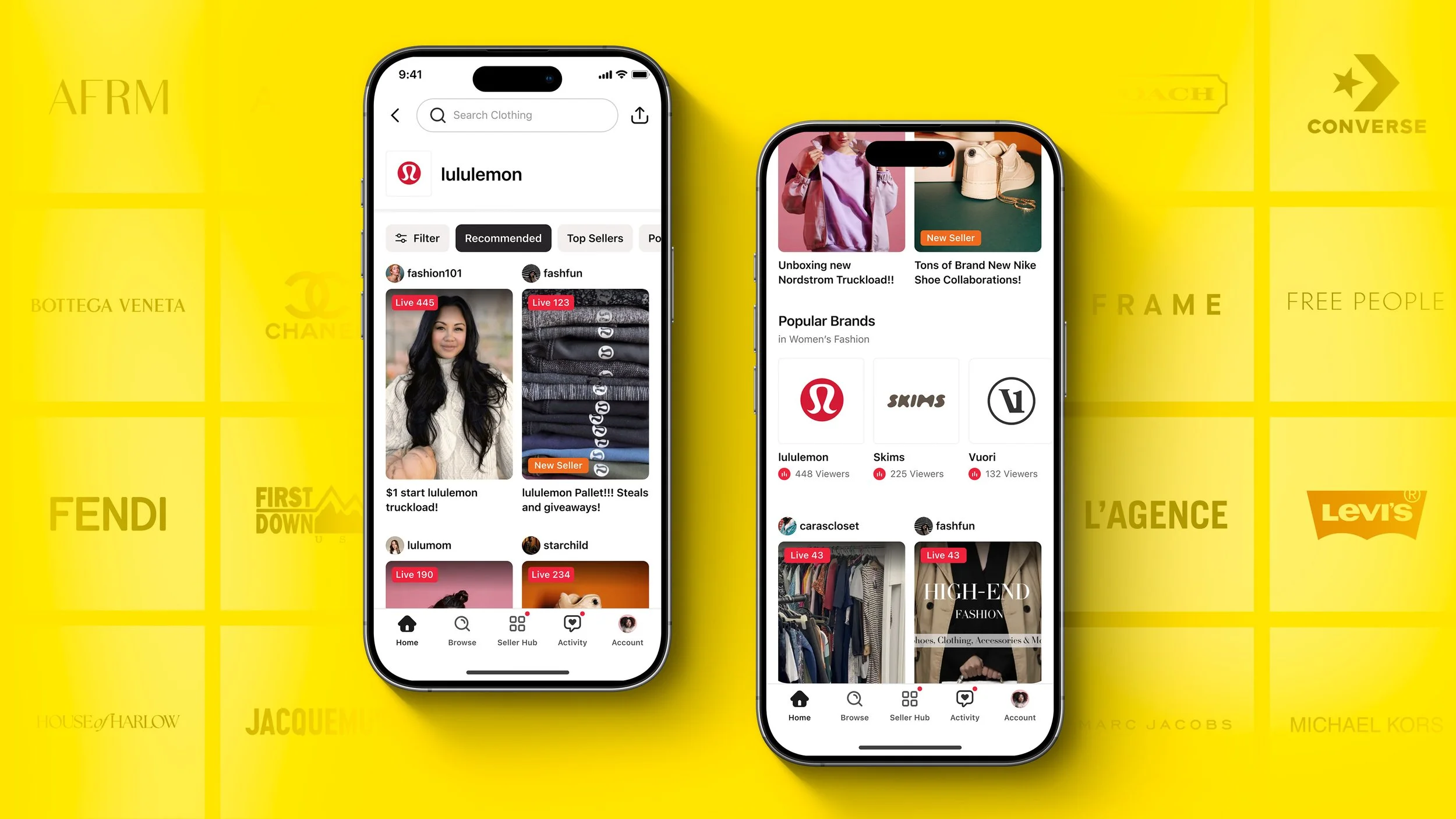

Live shopping is redefining how Britain shops and discovers new products. Globally, Whatnot reached over $6 billion in sales so far in 2025, more than doubling from the previous year, as shoppers embraced a more interactive, community-driven way to find what they love. On Whatnot, trends emerge from shared passion and participation, giving a direct view into where demand, and culture, is moving next.

The numbers prove the shift: new UK buyers on Whatnot grew +300% in 2025, marking the fastest expansion outside the US. That growth turned Britain into live shopping's most dynamic market, where collectors, creators, and communities come together in real-time to shape what sells next.

From combat sports cards rivalling football to Pop Mart's nationwide takeover, British buyers proved they value community consensus over marketing campaigns and prioritise shared discovery over solitary scrolling.

What UK buyers searched for on Whatnot in 2025 signals where the platform, and the culture, is heading in 2026:

Combat Sports Cards Outpace Growth in Football

UFC (Ultimate Fighting Championship) grew +100% whilst WWE (World Wrestling Entertainment) climbed +170% and wrestling searches jumped +1,620%, proving combat sports are now a core category, not a curiosity.

British collectors are expanding their sports portfolios beyond football, with NFL (American football) up +50% and basketball (+20%) showing U.S. athletes claiming lasting space in UK collections as the NFL International Series brings more regular-season matches to London.

But football isn't disappearing, it's getting personal. West Ham (+500%), Nottingham Forest (+260%), and Everton (+200%) showed that fans collect their local clubs, not just superstar players. Topps Premier League, a new card product line, saw +550,000% growth, proving how new products can ignite national demand when they tap into club loyalty rather than individual player hype.

Graded Character Cards Replace Sealed Boxes

Pokémon collecting shifted from sealed boxes to specific characters. Mewtwo searches rose +380%, Umbreon +260%, and Gengar +230%, whilst single Pokémon cards jumped +1,330%. Buyers are targeting the characters they want, not hoping for them in random packs.

Professional grading became the baseline: Pokémon slabs (professionally graded cards sealed in protective cases by companies like PSA) grew +860% and general slab searches +900%, as condition assessment and certification turned from luxury to expectation.

Meanwhile, vintage Pokémon searches rose +560%, Elite Trainer Boxes (premium Pokémon product bundles) +1,140%, and Crown Zenith (a popular recent set) +410%, confirming that sealed sets and classics remain long-term investments even as the market matures.

Fashion's New Reality: When High Street Pulls Back, Resale Steps In

Y2K (year 2000 aesthetic) searches rose +790% as low-rise jeans, baby tees, and butterfly clips defined a new era of nostalgia. But the most significant shift came from necessity: as major retailers scaled back plus-size offerings, resale filled the gap.

Plus-size fashion increased +770%, with "womens plus size" up +4,440%, as British shoppers turned to live shopping and peer-to-peer marketplaces to find the extended sizing options disappearing from high street stores.

Retro sneakers dominated: New Balance, an American athletic shoe brand known for chunky dad shoe silhouettes, grew +990%. Nike P6000 broke through, and terrace classics (sneakers historically worn by British football fans) like Adidas Samba (+800%) and Gazelle (+340%) reinforced that comfort and heritage drive staying power. The UK proved that lasting style beats temporary hype.

UK Embraces Asia's Blind Box Revolution

Labubu, a collectible designer toy character created by Hong Kong artist Kasing Lung, grew +413,650% in toys and +106,100% in sneakers (as bag charms), whilst Pop Mart (the parent company) brand searches rose +5,170% and blind box (mystery packaging where buyers don't know which variant they'll receive) interest climbed +9,520%.

The UK embraced the mystery format that defines modern collecting, prioritising visual appeal and creativity over nostalgia alone. Skullpanda, another Pop Mart character line, climbed +34,200% as design became the primary driver of value.

LEGO searches rose +120%, with Star Wars sets up +110%. From £8 minifigs (minifigures, small LEGO characters) to £400 builds (large display sets), LEGO's tiered pricing keeps it collectible for every buyer, proving that accessibility and aspiration can coexist.

Science-Backed Skincare Overtakes Prestige Brands

P.Louise, a British makeup brand founded by Liverpool-based artist Paige Louise, soared +132,500% to become the UK's most-searched beauty brand. British buyers rewarded brands that pair storytelling with quality, choosing homegrown heroes over global giants.

Skincare searches climbed +680% as results-first brands gained traction. The Ordinary, CeraVe, and Glow Recipe entered the mix, whilst Drunk Elephant (+1,370%) and Tatcha (+2,170%) showed demand for science-backed formulas over marketing claims. British buyers proved they prioritise efficacy and ingredients (what actually works) over packaging and prestige.

What This Means for 2026

In 2025, the UK became live shopping's proving ground for what sells next. Combat sports cards outperformed football, Pop Mart redefined design collecting, and inclusive fashion became non-negotiable. Breakout names like P.Louise, LEGO, and New Balance proved that consistency and cultural fluency win long term.

The UK now stands as live shopping's innovation hub, where collectors, creators, and commerce move together, and where global trends are born.