2026 & Whatnot: How Live Shopping is Redefining Retail

Live shopping has arrived in the mainstream. Whatnot crossed more than $6 billion in sales in 2025, more than doubling from the previous year, as millions of Americans embraced a more interactive way to find what they love.

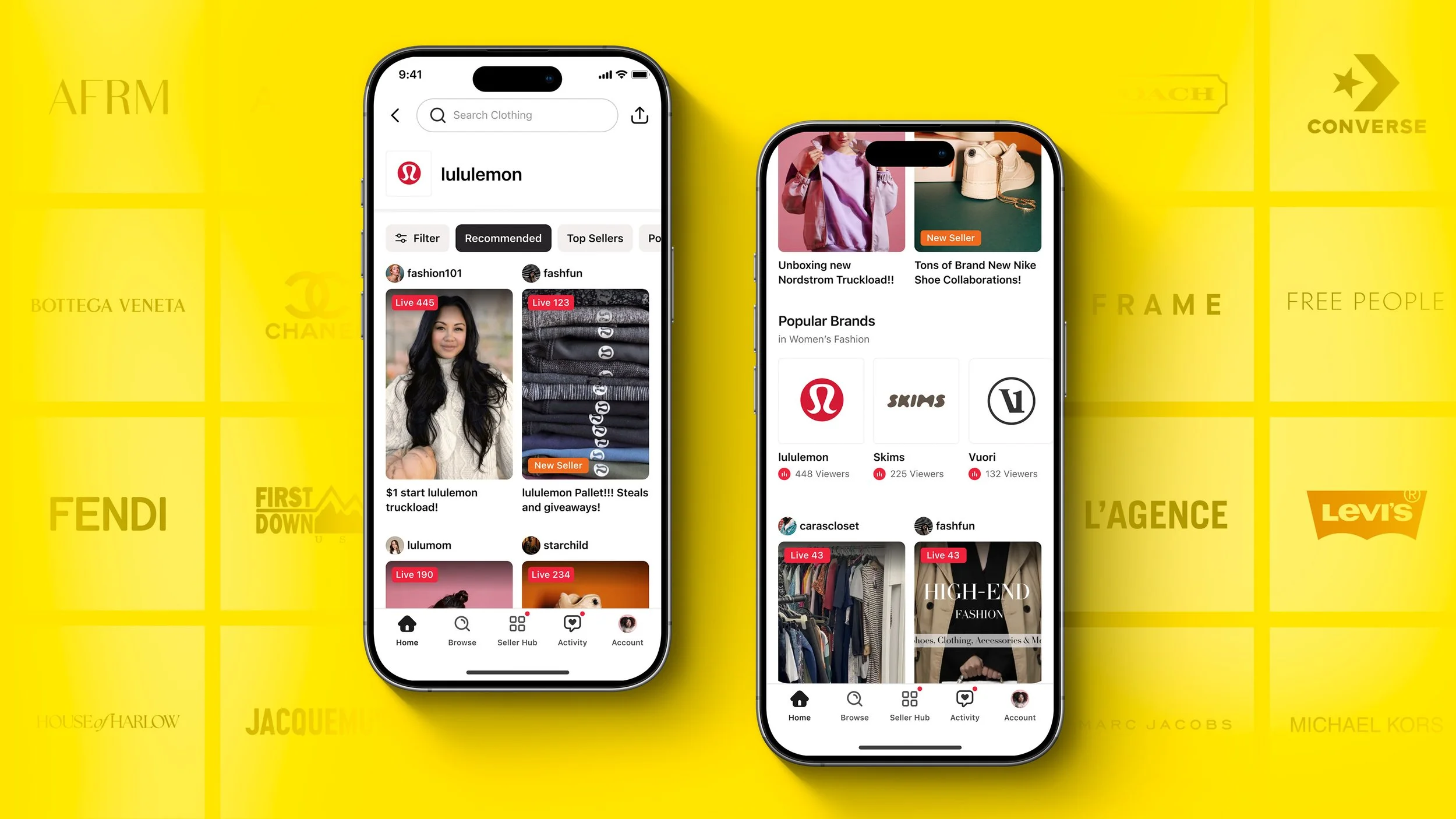

What started as a hub for collectibles now spans hundreds of categories, from sports cards and coins to fashion, beauty, and toys. The share of women shoppers more than doubled over the past year, and buyers spend an average of 80 minutes a day on the platform: watching, chatting, and bidding alongside communities built around shared interests. It's shopping with real people, in real time.

That level of participation creates a direct view into where culture is heading. When people shop live through passion-driven communities, their searches and purchases signal what's rising before it hits the mainstream. Here's what U.S. buyers told us about 2026:

WNBA Cards Grow 3x Faster Than NBA as Women's Sports Go Mainstream

After WNBA searches on Whatnot climbed +870% in 2024, the category's momentum nearly doubled in 2025 with +1,670% growth—3x faster than NBA cards—establishing women's basketball as a sustained collecting category rather than a one-year trend.

The proof of this market maturation: a Caitlin Clark 1-of-1 autographed rookie card pulled during a live Whatnot break later sold at auction for a record-breaking $660,000. Interest extends far beyond Caitlin Clark to a deep bench of stars: Paige Bueckers (+530%), Cameron Brink (+330%), Aliyah Boston (+260%), and Aja Wilson (+240%) all posted triple-digit growth.

But cards aren't the only way fans are expressing their fandom. WNBA signed items grew +1,000%, while jerseys climbed +290%, signaling 2026 will see WNBA memorabilia expand beyond cards into wearables and authenticated collectibles.

Gold, Platinum, and Ancient Coins Replace Traditional Bullion

Goldback (physical notes embedded with fractional gold) climbed +545% as Americans sought spendable inflation protection. Ancient coins grew +455% as collectors prioritized historical narratives over pure bullion. Gold (+240%) outpaced silver (+115%) while platinum (+185%) emerged as the alternative metal, signaling continued diversification beyond traditional bullion as economic uncertainty drives demand for tangible assets.

Western and Boho Aesthetics Overtake Minimalist Fashion

Expect 2026 style to lean heavily into textured, expressive dressing. Aesthetic movements like western (+1,065%) and boho (+920%) are rapidly overtaking minimalism as consumers gravitate toward pieces with personality and craftsmanship. Fringe (+515%), embroidery (+415%), and flowy silhouettes (+550%) are gaining traction, with all the looks sharing one theme: louder, richer, and more individual.

At the same time, consumers, not retailers, will set the tone for inclusivity, sustainability, and fit. With many major brands scaling back extended sizing, shoppers have turned to resale to find what traditional retail no longer provides. Plus-size fashion jumped +590% while men's big and tall grew +860%, and bamboo fabric grew +1,540% as sustainable basics replace fast fashion.

Together, these shifts point to a 2026 fashion landscape where expression, inclusivity, and circular shopping define what's in style.

Childhood Nostalgia Will Fuel the Hottest Collectibles

Pop Mart had a meteoric rise worldwide in 2025. Labubu debuted on Whatnot this year and sales have since grown 130% month over month, alongside similar collectibles like Skullpanda, Crybaby, and Dimoo.

But in 2026, nostalgia will shape the next era of collecting as millennials and Gen Z seek comfort in their earliest cultural memories. Classics are experiencing major revivals: Calico Critters (+1,735%), Lalaloopsy (+950%), Littlest Pet Shop (+700%), Beanie Babies (+590%), Furby (+195%), and Care Bears (+140%).

Press-On Nails and Bold Makeup Replace Clean Girl Aesthetic

The "clean girl aesthetic" is out: 2026 beauty will be bold, expressive, and DIY-driven. Glitter (+945%) and eyeshadow palettes (+995%) are powering the return of vibrant makeup looks, paired with perfumes that are anything but subtle. Bath & Body Works searches climbed +885% alongside gourmand scents like vanilla (+1,825%) and cherry (+850%), signaling a full sensory shift.

The desire to DIY extends beyond makeup: press-on nails grew +3,085% as consumers embrace affordable at-home luxury. Together, these shifts point to one clear direction for 2026 beauty: maximalism is officially back on top.

The Cities Driving Change

But nationwide search trends tell only part of the story. Buying behavior revealed how geography and local culture shaped every transaction. In 2025, five cities emerged as bellwethers of this shopping transformation: Atlanta, Chicago, Dallas, Miami, and Phoenix. Each developed a distinct live shopping identity reflected in what people purchased:

Atlanta led national purchase growth in WNBA cards, up +7,300%, turning Caitlin Clark rookies and women's basketball into must-collect categories overnight.

Chicago drove the precious metals boom with platinum up +15,300%, making it the national leader in alternative asset investing amid economic uncertainty.

Dallas became the extended sizing capital, with plus size fashion orders up +605%, more than double any other major city, as resellers filled gaps left by traditional retail.

Miami recorded the nation’s highest per-capita Labubu purchase rate on Whatnot, with summer and fall sales growing 1,455% over spring as the character captured 12% of the city’s overall toy market, outpacing Funko and Disney.

Phoenix led K-beauty adoption with purchases up +3,250%, the highest in the nation, as Gen Z embraced Korean skincare alongside press-on nails (+1,210%) that replaced salon visits.

Live shopping moves at the speed of culture now, and these five cities are setting the pace:

-

WNBA Cards Become Atlanta's Fastest-Growing Collectible Category

Atlanta has always known how to spot a winner early. It's the city where collectors have treated sports like investments for decades, where card shops have been institutions since before grading companies existed, where the difference between being early and being first can make or break a portfolio.

So when WNBA cards exploded 7,300% on Whatnot in 2025, the highest growth rate in the nation, it wasn't just about Caitlin Clark breaking television records or the league signing its most lucrative media deal in history. It was Atlanta's collecting community recognizing what the mainstream was only beginning to understand: women's basketball had crossed from cultural moment to legitimate asset class.

Panini Prizm rookies moved through live breaks with the same intensity as NFL cards (+800%), which have long dominated Atlanta's sports collecting scene. Soccer cards (+755%) reflected the city's growing international population and Messi's Inter Miami effect, while WWE wrestling cards climbed 765% as entertainment collectibles gained mainstream credibility.

What This Means for 2026:

Atlanta is building a diversified collecting portfolio: international (soccer), rooted in tradition (MLB cards up 493%), and unafraid to bet early on what's next (WNBA). The city's overall sports card market grew 160% in 2025, but the real story isn't the numbers. It's that Atlanta treated women's sports like what they've always been: worthy of the same respect, investment, and enthusiasm as anything else worth collecting.

-

Platinum and Precious Metals Define Chicago's Alternative Asset Strategy

Chicago doesn't chase trends, it builds portfolios. It's a city shaped by commodities trading, where the CME has set global prices for over a century, where financial pragmatism runs as deep as the L tracks. So when inflation headlines dominated 2025 and economic uncertainty sent investors scrambling, Chicago collectors on Whatnot didn't panic. They pivoted to what they know best: hard assets with real weight.

Silver bullion purchases jumped 510% year-over-year, led by no-nonsense 1 oz and 10 oz bars, the kind of standard weights that move through trading floors. Buffalo rounds and American Silver Eagles dominated government-minted products, while gold bullion exploded 2,010%, with U.S. Mint products significantly outpacing generic rounds.

But Chicago's precious metals strategy revealed something more nuanced than simple flight to safety. Fractional gold (+1,550%) offered accessible entry points at 1/10 oz and 1/4 oz increments, democratizing an asset class traditionally reserved for high-net-worth buyers. Morgan silver dollars (+1,285%) brought vintage numismatic appeal into the mix, bridging collectible history and intrinsic value.

And then there was platinum, up 15,300%, the highest growth rate in the nation. In a city that understands industrial commodities as well as collectible appeal, platinum's dual nature as both rare metal and manufacturing essential made perfect sense.

What This Means for 2026:

Chicago is building a precious metals portfolio that reflects the city's financial DNA: diversified, pragmatic, and rooted in tangible value. Ancient coins (+1,040%) signal collectors are expanding into Roman and Greek numismatics, while Peace dollars (+330%) complement Morgan dollar momentum. Whatnot's live format offers something Chicago's traders instinctively understand: real-time price discovery and authentication.

-

Plus-Size Fashion Makes Dallas the Nation's Inclusive Sizing Capital

Dallas has never been a city that waits for permission. It's where big hair was a power move, where cowboy boots meet couture, where style has always been about confidence over conformity. So when plus size fashion purchases on Whatnot jumped 605% in 2025, more than double the growth rate of any other major city in the nation, it wasn't a trend; it was Dallas refusing to accept that fashion should only work for some bodies.

As major brands scaled back inclusive sizing lines, Dallas shoppers turned to Whatnot's live resale market to find what brick-and-mortar stores refused to stock.

But the city's fashion identity in 2025 extended beyond sizing. Denim jumped 270%, with Levi's leading and barrel-leg, flare, and straight cuts replacing the skinny jean stranglehold. Vintage and Y2K aesthetics grew 265%, with Free People and Target emerging as the most resold brands, a combination that perfectly captures Dallas style: aspirational but accessible.

What This Means for 2026:

Dallas proved that inclusive fashion isn't a niche market, it's the market. The city's dominance in plus size growth signals a permanent shift where extended sizing becomes the baseline expectation. Brands that treated plus-size as afterthoughts in 2025 will be forced to rethink manufacturing and inventory strategies in 2026, or risk losing an audience that has already found alternatives.

-

Labubu Art Toys Transform Miami Into America's Blind Box Hub

Miami has always been America's gateway city. It's where Latin America meets North America, where international trends arrive before the rest of the country even knows to look for them, where cultural currency moves as fast as the convertible kind. The city posted the nation's highest per-capita Labubu purchase rate, with the character capturing 12% of Miami's overall toy market and outpacing both Funko and Disney by summer's end. The trajectory was explosive: summer and fall purchases grew 1,455% over spring.

Blind boxes drove roughly 20% of all Labubu purchases, with companion character Zimomo showing strong secondary demand. The format perfectly matched Miami's appetite for discovery, for the thrill of the reveal, for collectibles that feel like insider knowledge. Sonny Angel purchases jumped 10,390%, confirming that collector appetite for kawaii aesthetics extended far beyond Pop Mart into a broader Asian toy culture that Miami embraced faster than any other American city.

Disney collectibles jumped 535%, blending licensed nostalgia with the same discovery mechanics that made art toys irresistible. Pokemon cards climbed 245% as trading card games converged with toy collecting culture, while LEGO grew 245%, with Star Wars sets blurring the line between play and display for adult collectors. The most telling shift? Funko Pop's superhero dominance, with Marvel up 4,800% vastly outpacing Disney's 145%, signaling a generational handoff where MCU nostalgia rivals Mickey Mouse.

What This Means for 2026:

Miami proved that the future of collecting is global, tactile, and driven by discovery. Plush collectibles soared 2,700% and Barbie climbed 260%, expanding the city's toy market beyond vinyl into categories that offer physical comfort alongside visual display. Miami isn't waiting for trends to go mainstream. It's the place where mainstream begins.

-

K-Beauty and DIY Nails Replace Traditional Beauty Retail in Phoenix

Phoenix has always understood value differently than coastal cities. It's a place where practicality meets aspiration, where the desert heat demands skincare that actually works, where Gen Z grew up watching tutorials instead of going to counters. So when press-on nail purchases jumped 1,210% on Whatnot in 2025, it wasn't about cutting corners. It was about rejecting the idea that beauty should cost a week's groceries.

Custom designer press-on sets at $10 to $30 replaced $50+ salon visits as social media tutorials democratized professional-looking results. Gen Z didn't see this as settling. They saw it as smarter spending, reallocating salon budgets toward premium skincare and makeup brands that posted triple-digit gains. The result: Phoenix's overall beauty market grew 570%.

K-beauty brands exploded 3,250%, the highest growth rate in the nation, with Laneige leading the charge as Korean innovation bridged affordability and efficacy. Fragrance climbed 1,670%, signaling that Phoenix treated scent as a core beauty category, while beauty tools grew 715% as facial rollers and gua sha proved consumers were investing in the ritual, not just the product.

The most telling shift? Treatment actives grew 610%, with retinol, vitamin C, and hyaluronic acid products dominating as Phoenix's educated consumers prioritized ingredient-driven results over brand loyalty.

What This Means for 2026:

Phoenix proved that beauty's future isn't in department stores or influencer drops. It's in accessible luxury and ingredient transparency. Hair care grew 575% as treatment-focused products converged with skincare's active-ingredient approach, while premium brands like Tatcha, Glow Recipe, Drunk Elephant, and La Mer posted solid 215% growth. The best routine is the one you can actually afford to maintain.